What is Private Credit?

Private credit is defined as directly originated or negotiated loans provided to borrowers and not traded in the public markets. Lenders are typically alternative asset managers offering dedicated private credit funds to their investors. Borrowers can include a wide range of entities: companies, private markets funds, real estate and infrastructure owners, developers, and operators, consumers, intellectual property creators and owners, and others. For some borrowers, private credit has filled the gap left by traditional lenders’ decreased participation in certain markets in the wake of the Global Financial Crisis.

Private credit strategies span the capital spectrum, from senior credit to hybrid equity/credit solutions.

Potential Reasons to Invest

1. Potential for Premium Yields

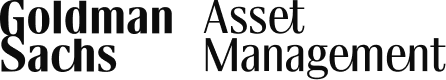

Private credit has historically generated higher yield than the most comparable publicly traded instruments: broadly syndicated loans and high yield of a similar credit rating1. Private credit has commanded wider (higher) spreads in exchange for greater sophistication, flexibility, customization, speed and certainty of execution, and ability to evaluate complexity that may impede borrower access to traditional capital.

Average Yield, Last 10 Years

1.Source: Cliffwater (private credit yields), Federal Reserve (high yield yields for the ICE BofA indices). As of 12/31/2023. Past performance is not indicative of future results.

2. Resilience

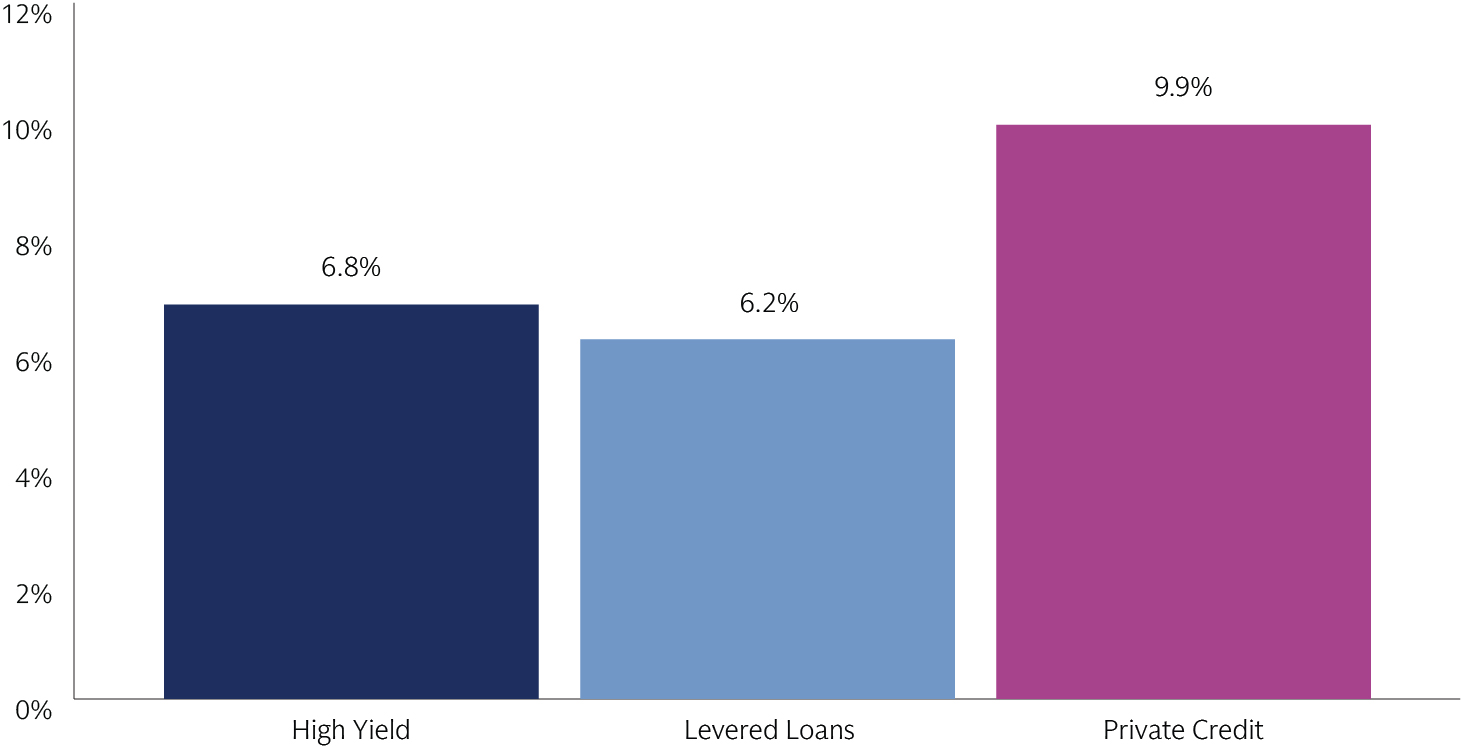

Private credit has historically maintained loss ratios that are lower than those of high-yield fixed income instruments and generally in line with broadly syndicated loans. Deep access to company records received by private lenders enables stronger due diligence and documentation than may be the case in public markets. The ability to select investments without the need to manage to a benchmark can be a potential downside mitigant. Furthermore, private credit typically features a single entity or a small group lending to a borrower. This enables the use of customized structural protections that can mitigate losses, and can make for quicker and more efficient workouts — and potentially greater recovery — in case of default, compared to publicly syndicated debt instruments that are more standardized and feature multiple lenders with competing priorities.

Average Credit Loss

Source: Cliffwater as of December 2023. Private Credit is represented by the Cliffwater Direct Lending Index. High Yield is represented by the Bloomberg US High Yield Index. Levered Loans are represented by the LSTA leveraged loan index. Represents the average of annual credit losses over the 10 years through 2023.

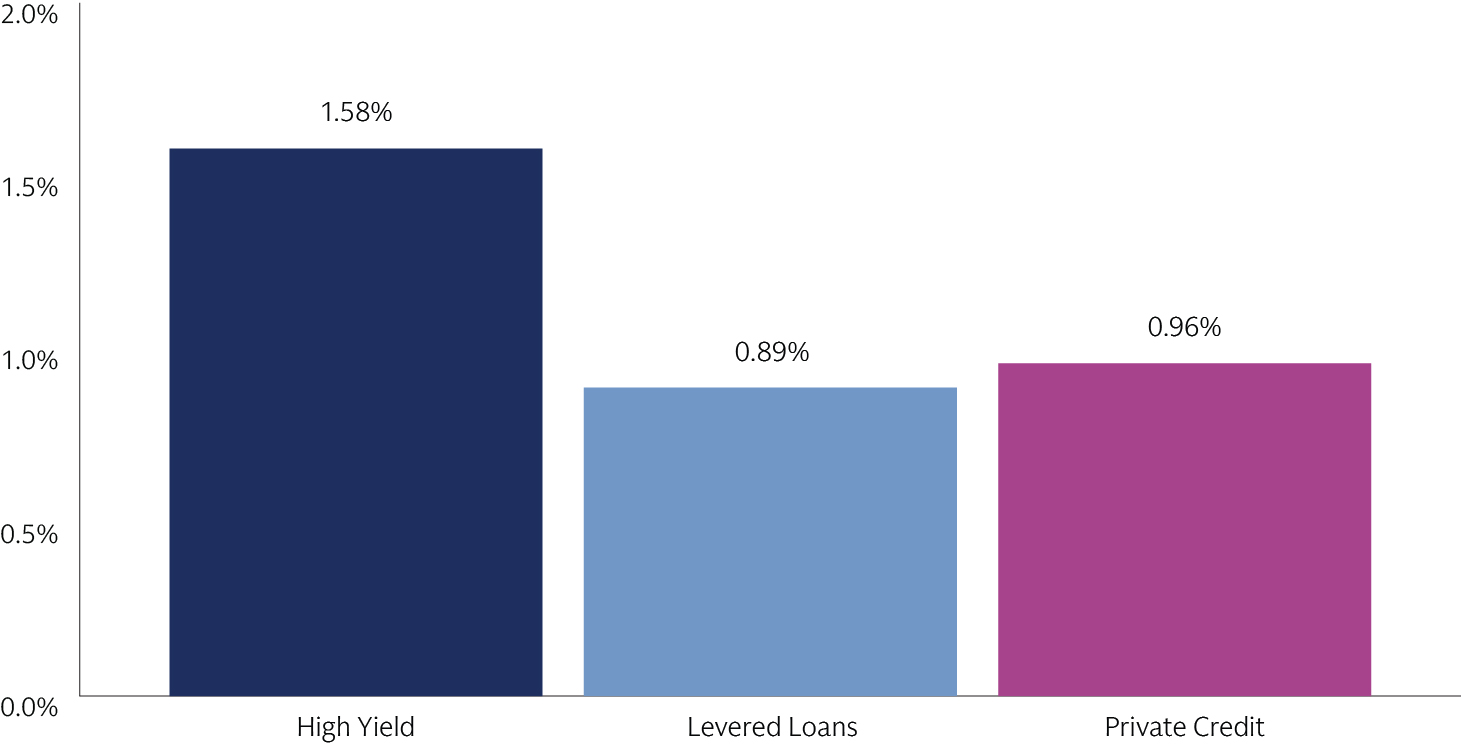

3. Diversified Opportunity Set

The addressable market in private credit has exhibited robust growth and is increasingly diversified across the spectrum of size, collateral, and sensitivity to the economic cycle. This enables the investor to customize their exposures in the credit space. Some strategies are primarily floating-rate, mitigating their interest-rate sensitivity; others are fixed-rate. Some strategies, such as performing corporate and real asset credit, tend to move with the economic cycle. Others, such as distressed and opportunistic, may be more counter-cyclical, with a more attractive opportunity set during challenging economic times. Hybrid equity/credit strategies may be all-weather (across the cycle). Some specialty credit strategies are tied to assets with idiosyncratic profiles and are less sensitive to the cycles of the broader economy.

Assets Under Management (USD trillion)

Click here to access data for the line chart listed above.

Source: Preqin, as of December 2023.

Private credit involves an investment in non-publically traded securities which may be subject to illiquidity risk. In addition, portfolios that invest in private credit may be leveraged and may engage in speculative investment practices that increase the risk of investment loss.