What is Private Equity?

Private equity refers to investments in the equity of companies not traded in the public markets, and can include investments in everything from new start-up companies to mature, well-established businesses. Private equity funds typically seek to increase the value of the businesses they own by influencing their strategic direction, guiding expansion, providing operational expertise, and/or optimizing their capital structures before ultimately monetizing each investment through an initial public offering, sale or other event.

Potential Reasons to Invest

1. Potential for Long-Term Growth and Enhanced Returns

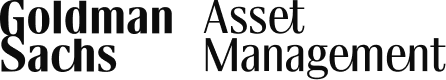

Private equity has, in aggregate, outperformed public markets over a variety of time frames, by 3-5% annualized (net of fees) depending on the time frame – and not only due to differences in leverage, sector or style composition compared to public benchmarks.1 We believe this outperformance is driven by access to differentiated opportunities and by active value creation inherent to private equity ownership.

Private capital typically features a higher cost of capital than public capital – with the benefits accruing to the investors that supply it. Yet companies are increasingly choosing private capital due to lower indirect costs (e.g., administrative and regulatory costs of being public), a more efficient governance structure that supports long-term value creation without emphasis on interim results, and the benefits delivered by a value-added partner who can lend expertise as well as capital to help the company grow and transform. Such benefits are particularly valuable to companies undergoing meaningful change or a pivot in their trajectory.

Private Equity Outperformance over Global Equities

Source: Cambridge Associates, as of 12/31/2023. PME is a public market equivalent methodology that measures the performance comparison between a private investment and a public alternative. PME methodologies assumes that inflows are used to purchase public shares whose sale produces outflows, all of it done per the private schedule. Under PME, actual private contributions are invested in the public market index. Distributions are calculated in the same proportion as in the private investment. In essence, the public equivalent “sells” the same proportion of the dollar value of public shares contained in the calculated NAV as the private investment sells in private shares. Public returns, combined with these PME cash flows, generate a public-equivalent NAV stream. The PME outperformance is calculated from the sample IRR minus the PME Index IRR. This calculation does not adjust for leverage, hedging, or other risk factors that may be present in the private equity investment. Unlike public equity investments, private equity is illiquid and may not be readily sold for its stated value. Positive PME outperformance indicates outperformance compared to the index return, and negative PME outperformance indicates underperformance. Private equity PME vs. the MSCI World index

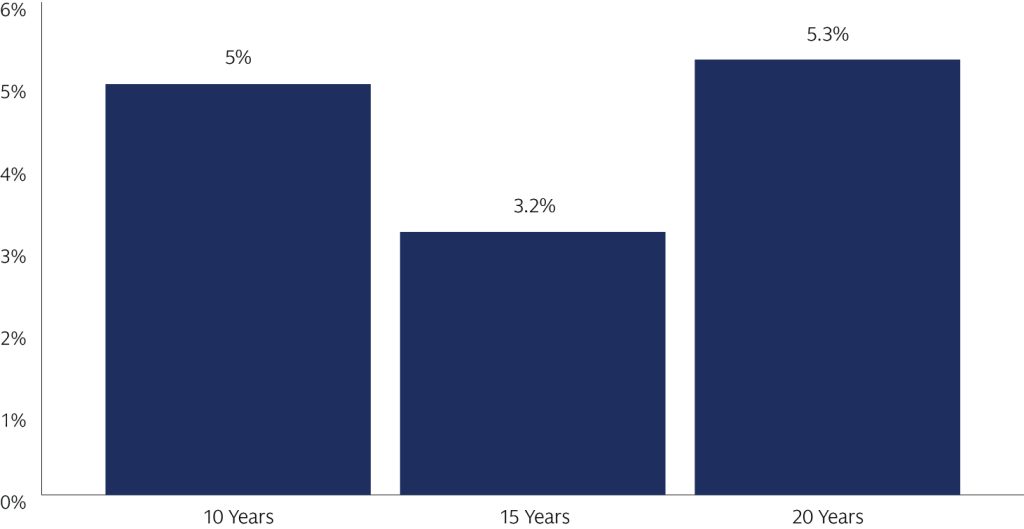

2. Wider Opportunity Set Than Public Equity Market

A meaningful portion of value creation that was previously generated in public markets is now being built under private ownership. Across many developed markets, the number of public companies has decreased in recent years, while the number of private equity-backed companies has expanded.2 In addition, companies are staying private for longer, spending more of their most innovative, highest-growth years under private ownership.

Private equity is able to support companies across a broader range of company development stages than is the case in public markets. Private equity investments span the company lifecycle, from early-stage companies with innovative ideas which may be too young for public markets (venture capital and growth equity), to mature businesses (buyouts) to companies in need of meaningful change in operations, capital structure, or both (structured solutions). All of these stages can offer attractive opportunities for investors.

Total Number of Companies

Sources: Private equity companies over time: PitchBook, as of 12/31/2023. Excludes venture-backed companies. Public companies over time: World Bank, McKinsey.

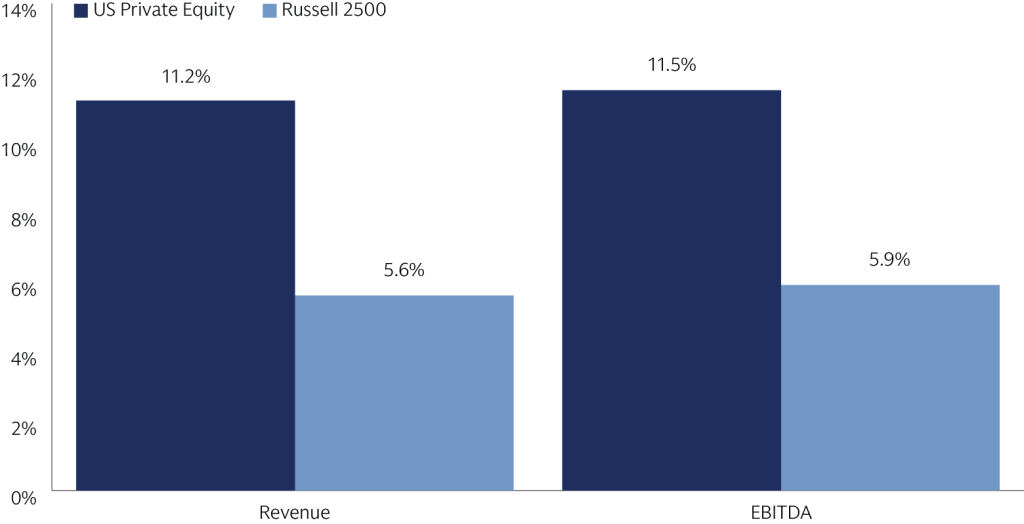

3. Operational Value Creation

Private equity managers are active owners, working hand-in-hand with their portfolio companies to boost growth trajectories, enhance operating efficiency, and, in many cases, transform the company for long-term value creation. Since private fund managers have more concentrated ownership of the companies they own, as compared to public equity managers, it is easier for them to influence their portfolio companies.

Experienced managers have extensive expertise in everything from growing and scaling businesses, to improving strategy and operations, to integrating technology for growth and efficiency. We believe this expertise is more important than ever in today’s environment of rapid change and emphasis on resiliency, agility and innovation.

A recent study has found that private equity-owned companies grew revenues and earnings by greater amounts than publicly owned companies of comparable size, and enjoyed higher margins.3

Operating Metrics Comparison: Public vs. Private Equity

Source: Cambridge Associates; US Private Equity Looking Back, Looking Forward: Ten Years of CA Operating Metrics. Median operating metrics for the period 2000-2020, returns for the period 2000-Q1 2022

Private equity investments can be risky since they provide exposure to private companies for which operating results in a specified period will be difficult to predict. Such investments may involve business and financial risk that can result in substantial losses. In addition, private equity funds can be illiquid and typically cannot be transferred or redeemed for a period of time.

- See, for instance, Robert S Harris, Tim Jenkinson and Steven N. Kaplan, “How Do Private Equity Investments Perform Compared to Public Equity?” (Journal of Investment Management, 2016), and “Has Persistence Persisted in Private Equity? Evidence from Buyout and Venture Capital Funds” (SSRN, March 2022); and “Performance Analysis and Attribution with Alternative Investments” Matteo Binfare, Gregory Brown, Andra Ghent, Wendy Hu, Christian Lundblad, Richard Maxwell, Shawn Munday, and Lu Yi—January 2022.

- Sources: Private equity companies over time: PitchBook, as of 12/31/2023. Public companies over time: World Bank, McKinsey.

- Source: Cambridge Associates; US Private Equity Looking Back, Looking Forward: Ten Years of CA Operating Metrics. Median operating metrics for the period 2000-2020, returns for the period 2000-Q1 2022